- Discover how New York homeowners can save up to 30% on solar installation costs with the federal tax credit

- Learn about the 25% New York State solar tax credit, capped at $5,000, and how to claim it

- Understand the NY-Sun PV incentive program rebate, offering $0.20-$0.80/watt, and the benefits of net metering

- Save up to $62,500 on NYC property taxes over 4 years

- Earn a 20% credit on historic home

Going solar in New York has never been more attractive, thanks to a range of incentives and tax credits available to homeowners. By understanding and leveraging these financial benefits, you can significantly reduce the cost of installing a solar photovoltaic (PV) system on your home.

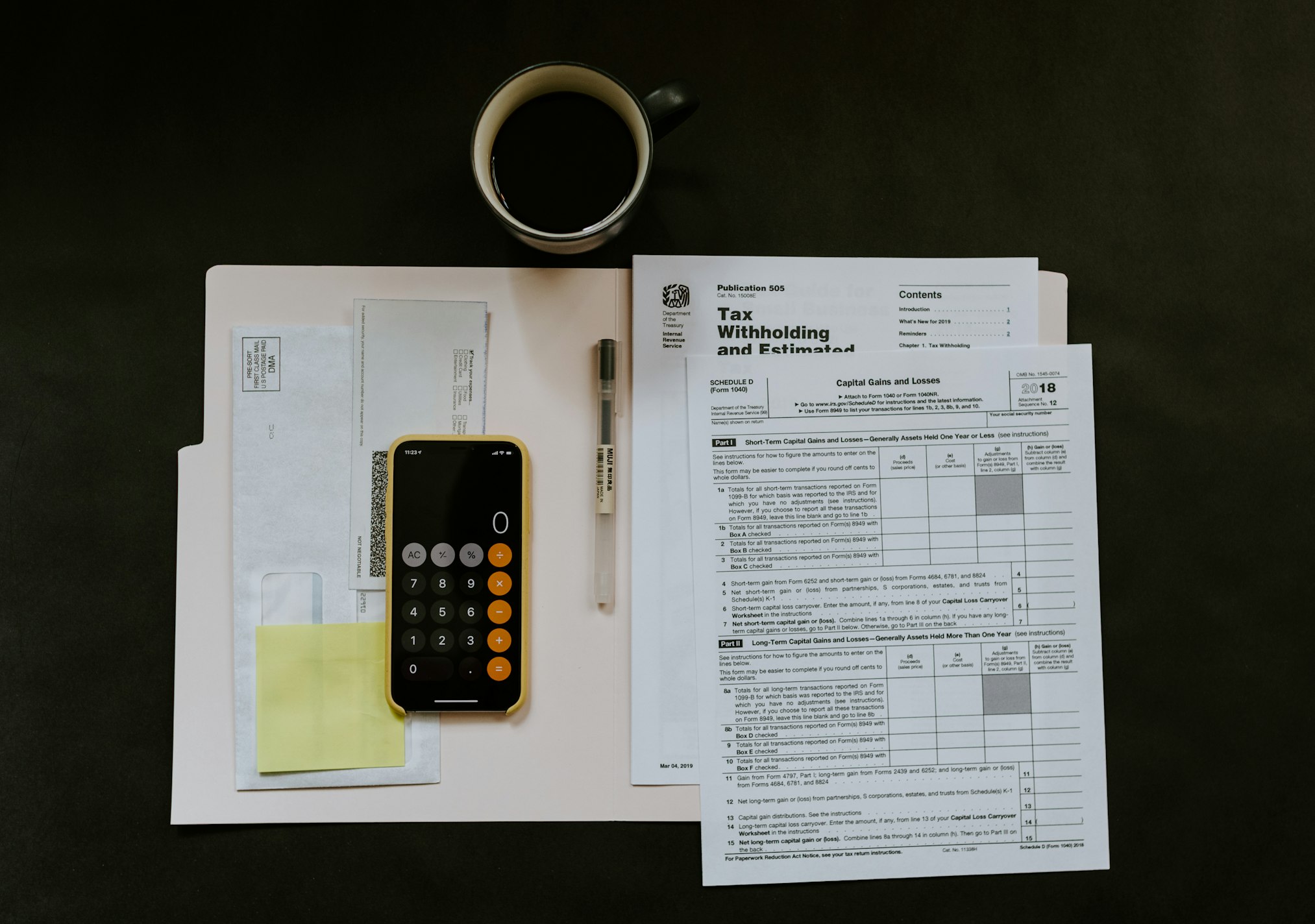

Federal Tax Credit for Solar PV Systems

- Eligibility: Solar PV systems installed between 2022-2032 are eligible for a 30% tax credit. The credit percentage phases down to 26% in 2033 and 22% in 2034.

- How to claim:

- File IRS Form 5695 with your federal tax return.

- Enter the total cost of the solar PV system on line 1.

- Calculate the credit amount (30% of the total cost) and enter it on line 6b.

- If you have any remaining credit from the previous year, enter it on line 12.

- Add up lines 6b, 11, and 12 to get the total credit amount.

- Transfer the result to Form 1040.

- Example: If a solar PV system was installed in 2022 and cost $20,000, the federal tax credit would be $20,000 x 30% = $6,000.

New York State Tax Credit for Solar PV Systems

- Eligibility: The solar energy system must be installed and used at your principal residence in New York State. The system must use solar radiation to produce energy for heating, cooling, hot water, or electricity for residential use.

- Credit amount: The credit is equal to 25% of your qualified solar energy system equipment expenditures, capped at a maximum of $5,000.

- How to claim:

- Complete Form IT-255 (Claim for Solar Energy System Equipment Credit) and submit it with your New York State tax return.

- Enter the purchase date and qualified expenditures for your solar energy system equipment in Schedule A of Form IT-255.

- Calculate the credit amount (25% of qualified expenditures, up to $5,000) and enter it in Column C of Schedule A.

- Transfer the total credit amount to your New York State tax return.

- Example: If a solar PV system cost $20,000, the New York State tax credit would be $20,000 x 25% = $5,000 (capped at $5,000).

NY-Sun PV Incentive Program Rebate

- Overview: The NY-Sun program provides incentives to make solar-generated electricity accessible and affordable for New York homeowners, renters, and businesses.

- Rebate amount: Rates range from $0.20 to $0.80 per watt installed, depending on the utility region and state solar capacity goals. For an average 6 kW system, the rebate would be between $1,200 and $4,800.

- Eligibility: The solar system cannot be sized more than 110% of the previous 12 months’ usage history to qualify for the incentive.

NYC Solar Property Tax Abatement

- New York City offers a property tax abatement for solar installations

- Deduct 7.5% of your system’s cost from property taxes each year for 4 years

- Maximum total deduction is $62,500

- To apply, submit Form PTA4 to the NYC Department of Finance

Historic Homeownership Rehabilitation Tax Credit

- For historic landmark homes on the State Register, get a 20% income tax credit for renovations over $5,000

- Solar improved is considered an approved renovation

Net Metering in New York

- How it works: New Yorkers who go solar qualify for full-retail net metering, which allows them to receive credits for excess electricity generated by their solar system and sent back to the grid.

- Customer Benefit Contribution (CBC) charge: Solar homeowners must pay a monthly CBC charge, ranging from $0.30 to $1.33 per kilowatt of solar installed, depending on the utility. For an average-sized solar system in New York, the CBC charge would be between $25 and $100 per month.

- Credit rollover: Net metering credits can be carried over to the next billing cycle, and any excess credits at the end of the year are compensated at the avoided cost rate.

While navigating the world of solar incentives and tax credits may seem daunting, reputable solar companies in New York are well-equipped to guide homeowners through the process. These companies provide transparent and professional approaches, offering accurate proposals, power production guarantees, and consultative sales processes to ensure that homeowners can maximize their solar savings.

By taking advantage of the federal and state tax credits, NY-Sun PV incentive program rebate, and net metering, New York homeowners can significantly reduce the upfront cost of going solar and enjoy long-term energy savings. Embrace the power of clean energy and join the growing number of New Yorkers who are making the switch to solar.

Discover eligibility and take action today!

Get in touch with us! Submit the form below and we’ll connect with you soon.